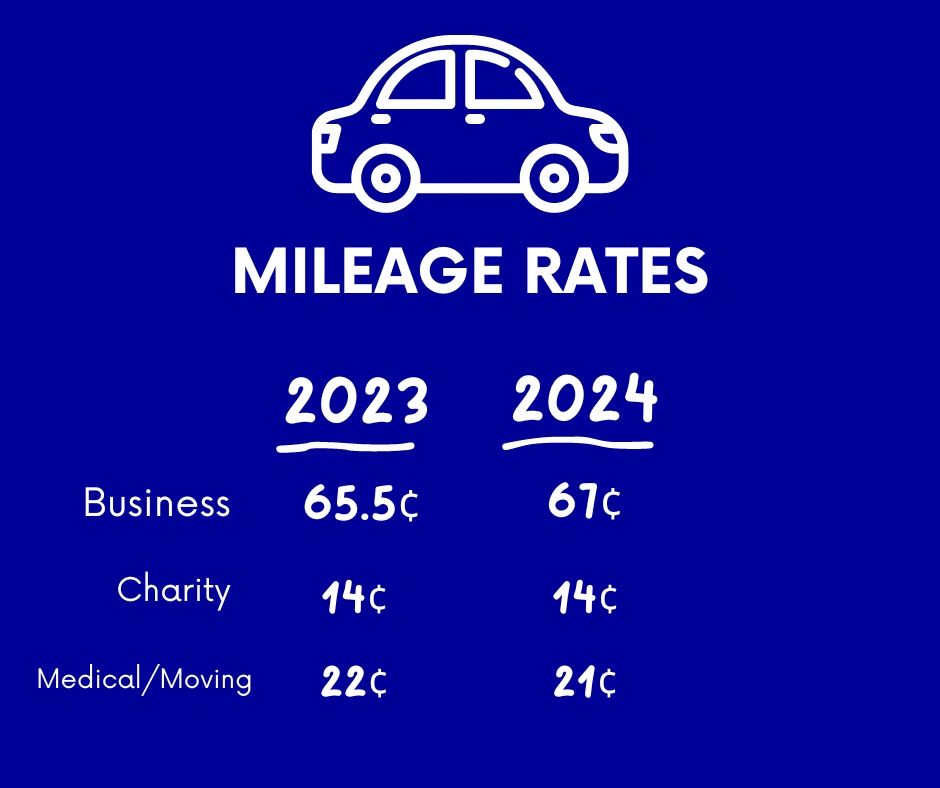

Irs Gas Mileage Allowance 2025 - The IRS has released the standard mileage rates for 2025., The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2023. 21 cents per mile for medical uses; The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2023.

The IRS has released the standard mileage rates for 2025., The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2023. 21 cents per mile for medical uses;

Current Gsa Mileage Rate 2025 Allyce Corrianne, In 2023, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving. Does mileage reimbursement include gas?

Irs Mileage Rate 2025 Cheryl Thomasina, The irs has announced their new 2025 mileage rates. For 2023, the standard mileage rate for the cost of operating.

Reimburse mileage rate 2025 aidan arleyne, the standard mileage allowance (rate per mile multiplied by miles traveled) is intended to cover automobile expenses such as.

Irs Mileage Calculator 2025 Allis Courtnay, In 2023, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving. The irs announced the 2025 business mileage rate, and it has increased for the fourth time in three years.

Irs Mileage 2025 Reimbursement Rate Kaye Nancee, The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents. 1, 2025, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will be:

2025 Irs Gas Mileage Audra Anallese, The new irs mileage rates for 2025 are 67 cents per mile for business purposes (up from 65.5 cents per mile in 2023), 21 cents per mile for medical or moving. Washington — the internal revenue service.

The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or medical. 67 cents per mile for business uses;

IRS Sets Mileage Rate at 67 Cents Per Mile for 2025 CPA Practice Advisor, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. The rate for medical or moving purposes in 2025 decreased to 21 cents.

Mileage Allowance 2025 Irs Bab Kevina, Clean energy and vehicle credits; You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

The irs announced the 2025 business mileage rate, and it has increased for the fourth time in three years.